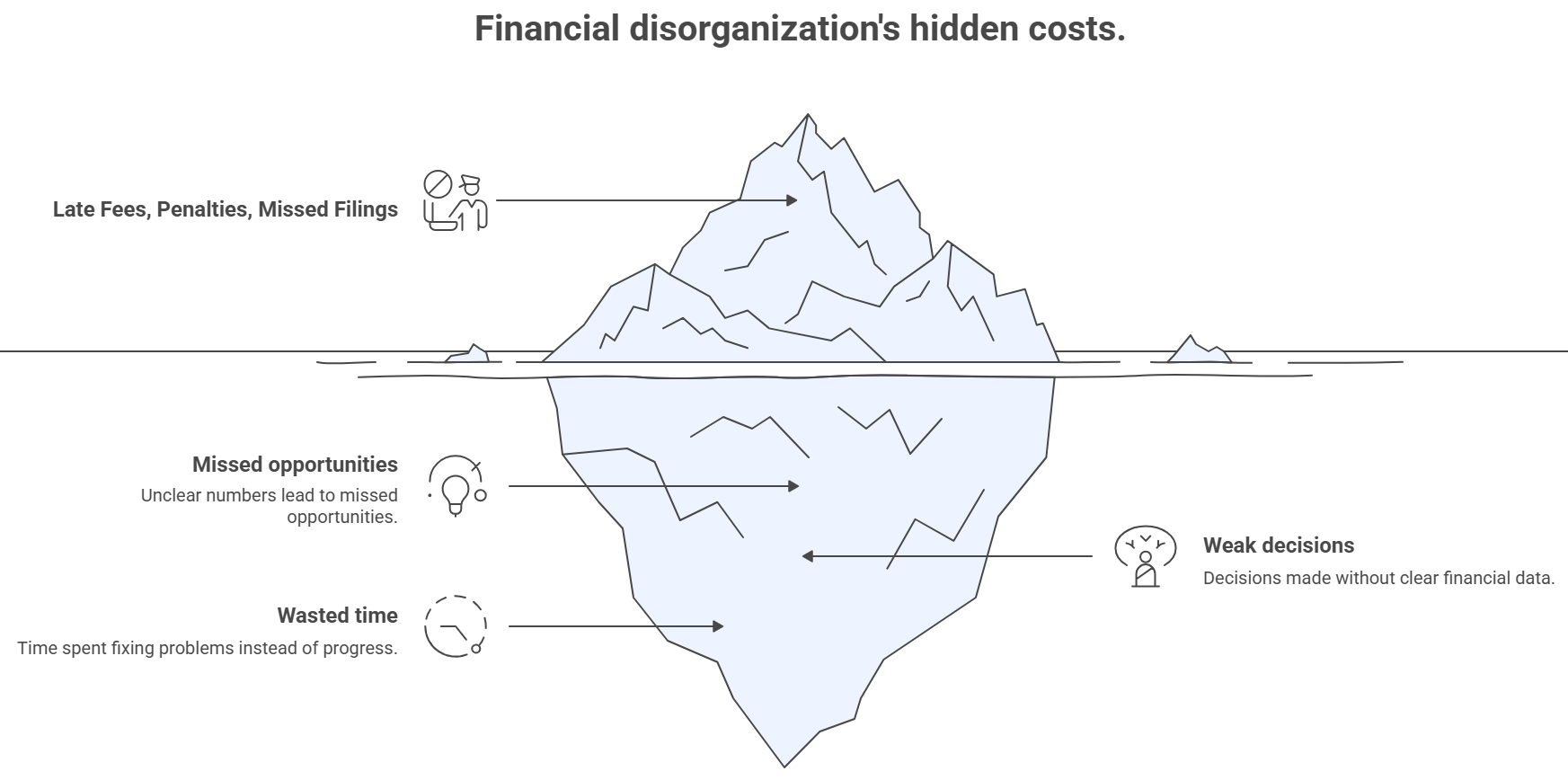

Fractional CFO & Operations for growing businesses

ESVP Management builds financial clarity, structure and accountability so founders and creators can scale with confidence.

We free founders from the constant financial guesswork, giving them a clear view of cash flow, profitability and runway - so they can make bold decisions with peace of mind.

What people are saying

How we work with our clients

Financial reporting

•

Cash flow management

•

Historical clean up and catch up

•

Month end close

•

Complex transactions

•

Sales tax compliance

•

Business license filings and renewals

•

W9 collection and 1099

•

Audit prep and ongoing support

•

Streamline internal controls and accounting processes

•

Accounts receivable

•

Accounts payable

•

Bill pay

•

FP&A

•

Scenario analysis

•

Investor ready reporting packages

•

Budget to actual analysis

•

Bookkeeping

•

Cap table maintenance

•

Strategic financial planning

•

R&D tax credit

•

Financial reporting • Cash flow management • Historical clean up and catch up • Month end close • Complex transactions • Sales tax compliance • Business license filings and renewals • W9 collection and 1099 • Audit prep and ongoing support • Streamline internal controls and accounting processes • Accounts receivable • Accounts payable • Bill pay • FP&A • Scenario analysis • Investor ready reporting packages • Budget to actual analysis • Bookkeeping • Cap table maintenance • Strategic financial planning • R&D tax credit •

CORE SERVICES

Our services

-

GAAP financials

Chart of accounts setup and optimization

Monthly, quarterly and annual close processes

Board and investor ready reporting Packages

Management reporting with department level P&L visibility

Audit ready financials

Monthly financial reviews

Transaction level carve outs

-

Scalable forecasting processes and delivering insights that drive strategic decisions

Balance strategic thinking with hands on execution, building models and processes that enable scenario planning, managing budgets, headcounts and designing reporting that communicates business performance clearly.

Develop and manage budgets across multiple portfolio companies in alignment with company goals

Budget to actual analysis and reporting

Model growth and runway across different scenarios

Variance Analysis

Scenario Modelling

Cash flow Management

Headcount planning processes

Company wide KPI’s

-

Oversee payroll operations

HR Compliance with Federal, State and International labor and tax regulations

Manage stock based compensation accounting

Scalable processes for headcount planning, payroll reporting and compensation expense forecasting for FP&A

-

Build and Maintain Finance Drive

Audit prep and ongoing support

Establish scalable processes, systems, controls and automation tools

Establish GAAP policies for revenue recognition, expense classification and capitalization

-

Shorten Accounts Receivable cycle

Bill Pay

Contractor Agreements

-

Proper Account Treatment

Revenue recognition including contracts, service agreements, renewals, deferred revenue

-

City Business Licenses

Secretary of State Tax Compliance

Federal Tax Compliance

W9 collection

1099 filings

Investment Basis Tracking

-

Identify where you have tax liability or establish nexus

File Sales Tax Returns

Remit Sales Tax Payments

-

Payroll tax credit for pre-revenue companies

Qualified research expense analysis

Multi-state R&D credit support

Documentation and audit-ready support

Year-over-year credit planning

-

SAFE Notes

Side Letters

Term Sheets

Investor Data Rooms

Investor ready reporting

Cap table Maintenance

Carta Maintenance

-

High net worth financial organization and planning

Individual tax strategy and annual tax coordination

Our company ethos

To provide entrepreneurs, creators, and business leaders with precise, transparent, and strategic financial management that empowers them to focus on what they do best. We combine technical expertise with proactive guidance to protect our clients’ financial health, uncover opportunities, and help them make confident, informed decisions in a changing business landscape.

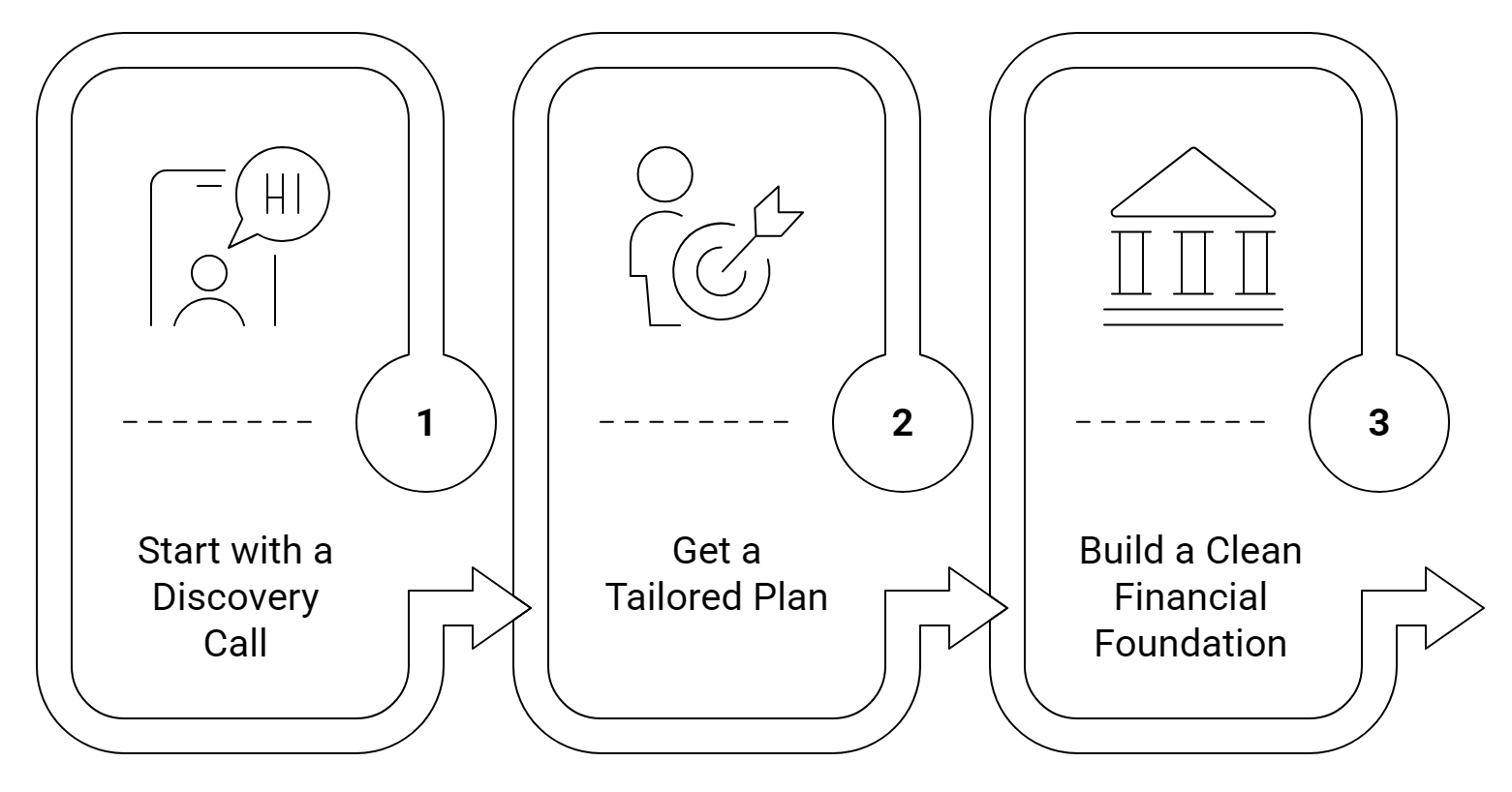

Schedule a call

Embark on your journey to financial excellence by securing an exclusive appointment with our seasoned financial experts. Experience bespoke strategies tailored to elevate your financial systems.